Financial Markets Conduct Act 2013, Employee Share Option Scheme Exclusion

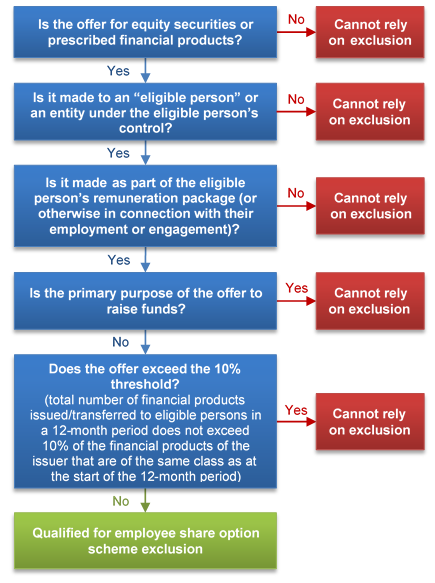

Set out below is an overview of the “employee share purchase scheme” exclusion.

It is important to note that even if an offer is made in reliance on an exclusion, the FMCA may still impose short-form disclosure, warning statements or other requirements on the offeror.

Please click here to see further information about the FMCA disclosure requirements and other FMCA disclosure exclusions. Benefits of offering an employee share schemeThe availability of this exclusion makes it easier for a company to implement an employee share of purchase scheme and businesses should consider taking advantage of these new rules to incentivise and retain key employee.

Employee share purchase scheme exclusionDisclosure under the FMCA is not required if an offer for financial products is made under a qualifying employee share purchase scheme. An employee share purchase scheme is essentially any arrangement under which employees or directors may acquire shares issued by the business. Remaining obligationsOfferors who rely on the employee share purchase scheme exclusion will still need to provide the following documents to the investor:

Disclaimer: This article is a general summary of complex laws and regulations that contain severe sanctions for breach and is not intended as legal advice. Specific legal advice should be obtained in relation to proposed marketing, offering or selling of financial products. All rights reserved © Jackson Russell 2017 |

Contact Darryl King, PARTNER |

1

1