Introduction

Part 4 of the Contract and Commercial Law Act 2017 (Act) (previously the Electronic Transactions Act 2002) is the legislative backdrop for electronically giving information and entering contracts. The main purpose of Part 4 of the Act is to:

Part 4 of the Act was drafted to be technologically neutral, meaning it is not tied to specific technology and should therefore be able to adapt to quick paced changes in technology. This note sets out an overview of the rules for creating legally binding contracts electronically and correctly using digital signatures.

When are electronic contracts legally binding?

The process of entering contracts electronically is essentially the same as when done in hard copy – an offer is required from one party and acceptance of the offer is required from the second party.

The Act clarifies the timing of contract formation by stating that when acceptance of a contract is sent by electronic communication (e.g. email or text), the contract is formed when the email/text arrives at the recipient’s address, not when it is read or sent. However, parties can contract out of this and specify in their agreement when contract formation takes place.

Electronic acceptance can occur in many ways. Businesses frequently exchange pdf copies of signed agreements by email and the contracts are formed by electronic counterparts. However this still requires printing and signing paper copies. With the move towards paperless offices, many businesses are looking to do away with paper copies and both sign and send acceptance electronically. For this to happen, electronic signatures need to be able to be relied on in the same way as handwritten signatures. “Digital signatures”, which are a subset of electronic signatures are a robust way to fulfil this need.

Electronic signature vs digital signature

There is an important difference between electronic signatures and digital signatures:

-

Electronic signatures are electronic methods of identifying a person and indicating their acceptance of a document e.g. pasting an image of your handwritten signature into a document, writing your signature or name by keyboard or stylus, clicking ‘I Accept’ etc. These methods generally do not have the same integrity as handwritten signatures.

-

Digital signatures are essentially electronic signatures that comply with the specific criteria set out in the Act (see summary below). The criteria under the Act is intended to ensure digital signatures can be used and trusted in the same way as handwritten signatures. PDF signatures do not meet this criteria. Specific software applications are needed to comply with this criteria.

When can digital signatures be used?

The Act allows documents that legally require a signature to be signed electronically as long as the signature used meets certain specified criteria. This also applies to the signatures of witnesses. While this criteria is not required for all contracts, it forms a good basis for the use of digital signatures in general.

For general agreements (i.e. those not covered by the Act) it is not strictly necessary for the parties to agree that the agreement may be signed electronically. However it can be useful to include a clause which stipulates the criteria for signing the agreement electronically e.g. in accordance with the Act.

Note that the Act specifically excludes some types of documents from being signed electronically e.g. wills, affidavits, statutory declarations, powers of attorney, negotiable instruments and bills of lading.

Requirements for digital signatures

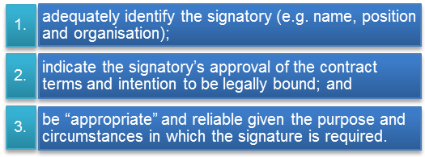

As with handwritten signatures, digital signatures can only be given by the signatory. Under the Act, a digital signature must:

Digital signatures presumed reliable

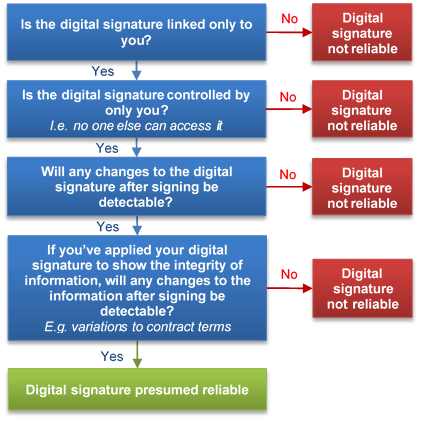

To allow parties to rely on the integrity of digital signatures as they would handwritten signatures, the Act provides that a digital signature will be “presumed” to be reliable if it meets the criteria summarised in the below flow chart:

If using digital signatures, we recommend doing so via one of the numerous applications which meet the statutory requirements. These applications only allow the signatory to access their digital signature and prevent changes to the document after it is “signed”.

Keeping electronic copies

If you are aiming for a more paperless office, it is useful to note that the Act states that keeping electronic copies of information satisfies any regulatory requirement to retain that information (even if it was originally in paper-based form) if:

-

Integrity: the method of keeping the electronic copies maintains the integrity of the information e.g. the document is kept in pdf or read-only form and protected against deletion; and

-

Accessible: the information is readily accessible so it can be used for future reference e.g. on an accessible server and easily accessed and/or searched; and

-

Transmission details: if the information was contained in an electronic communication:

-

information is also kept that identifies the origin, destination, time of sending and time of receipt of that electronic communication; and

-

that information is also readily accessible so it can be used for future reference.

As this ability does not extend to general contracts, it is useful to include a clause in agreements and terms of engagement stating that any information that the parties are required to keep can be kept in electronic form. We suggest such a clause includes the above requirements to ensure the integrity of retained information is maintained.

Conclusion

Electronic signatures are in common use already however, as digital signatures require specific technology, they are not as common yet. It is likely digital signatures will become more common as society becomes more electronically focused, especially as they provide more security against the risk of fraud. Becoming an early adopter of digital signature technology will help businesses set high internal standards when transitioning to paperless offices.

Until digital signature technology is more widespread it will be difficult for the normal method of signing to be by digital signature. However being an early adopter of digital signature technology will not only put businesses ahead of the game, it will also assist businesses transitioning to paperless offices by setting high internal standards for all document signing and electronic approval processes.

Disclaimer: The information contained in this publication is of a general nature and is not intended as legal advice. It is important that you seek legal advice that is specific to your circumstances.

All rights reserved © Jackson Russell 2017 |