Financial Markets Conduct Act 2013: Persons in Close Relationship Exclusion under the Disclosure Regime

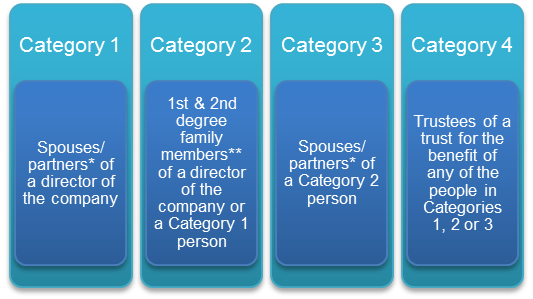

Set out below is an overview of the “persons in close relationship” exclusion that permits offers of financial products to persons closely connected to the issuer or its directors. It is important to note that even if an offer is made in reliance on an exclusion, the FMCA may still impose short-form disclosure, warning statements or other requirements on the offeror. Please click here to see further information about the FMCA disclosure requirements and other FMCA disclosure exclusions. Persons in close relationship exclusionDisclosure under the FMCA is not required if the offer of financial products is made to a person who has a ‘close relationship’ with the offeror. This exclusion also extends to any entity under that person’s control. A person is in close relationship with the offeror if they are a relative or a close business associate. RelativesRelatives are defined broadly under the FMCA into the categories shown in the image below:

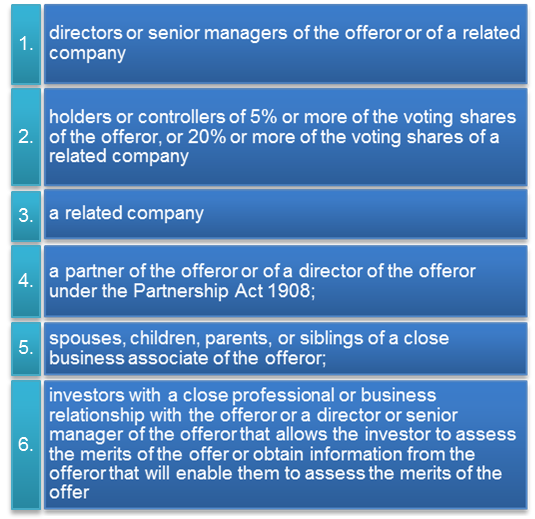

* ‘Spouses/partners’ includes civil union and de facto partners. Close business associatesA close business associate under the FMCA is defined as: We recommend relying on the first five categories, before relying on category 6 which requires a subjective assessment of whether the relationship is sufficiently close to avoid disclosure. A related company primarily means an offeror’s holding company, subsidiary or other member of a group. Remaining obligationsOfferors who rely on this exclusion will still need to comply with the ‘fair dealing’ provisions of the FMCA that prohibit misleading or deceptive conduct and representations that are false, misleading, or unsubstantiated.

|

Contact Darryl King, PARTNER |

1

1