Introduction

New Zealand generally welcomes foreign investment. The regulation of foreign investment in New Zealand is liberal by international standards.

New Zealand’s inbound investment rules regulate investments in New Zealand significant business assets, certain types of sensitive land (including farm land), and fishing quota.

The main inbound investment rules are the Overseas Investment Act 2005 (Act) and the Overseas Investment Regulations 2005 (Regulations). The “overseas investment regime” established by the Act and the Regulations is a consenting regime, rather than a prohibition. The regime governs who needs to obtain consent, when consent is required, and the process for obtaining consent.

This guide provides an overview of New Zealand’s overseas investment regime.

Who is an overseas person?

The overseas investment regime regulates investments by overseas persons. An overseas person is a person who is:

- not a New Zealand citizen and is not ordinarily resident in New Zealand;

- a company incorporated outside of New Zealand;

- a company or other entity that is at least 25% owned or controlled by an overseas person or persons.

The Act also extends to investments by associates of overseas persons. Associate is widely defined by the Act, and is included to ensure that those persons ultimately controlling or owning an investment are caught by the Act.

Careful analysis is required where a person is in the process of becoming ordinarily resident in New Zealand to ascertain whether the Act will apply.

When is consent required?

The three key transactions requiring consent are investments (direct or indirect) in:

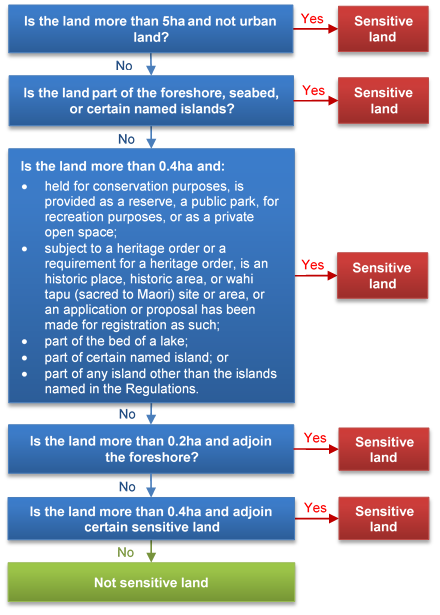

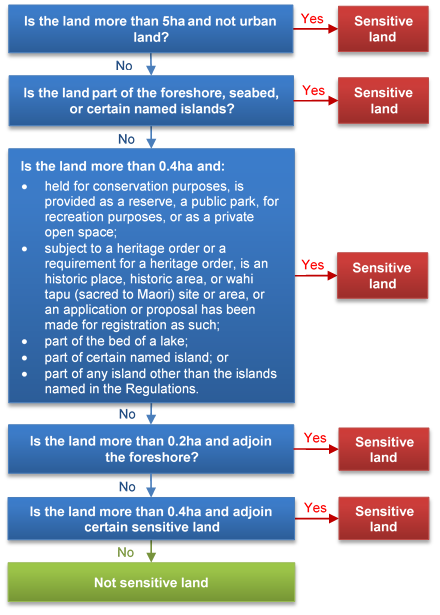

- sensitive land (including farm land) – see flow chart;

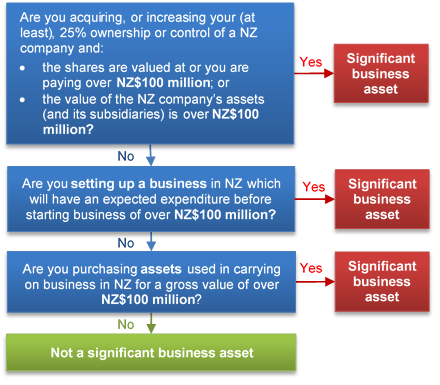

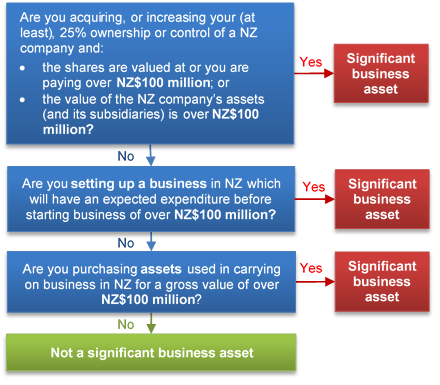

- significant business assets – see flow chart; and/or

- fishing quota (as regulated under the Fisheries Act 1996).

The tables below set out factors considered, and relevant tests applied by the regulator, the Overseas Investment Office (OIO), for each of these types of investment.

|

Is the land “sensitive land”?

|

Are the assets “significant business assets”?

|

|

|

Process for obtaining consent

The process for obtaining consent to an overseas investment can be complex, time consuming and costly. An overseas person will normally need the vendor to provide information and assistance.

Preparing the application

-

Timing: Applications must be lodged, and consent granted, before a transaction is given effect to. Any purchase agreement entered before consent is given should be conditional on obtaining OIO consent.

-

Contents: There are detailed criteria for consent applications. These are more detailed for land applications than non-land applications. An application must cover all of the criteria, including required supporting documentation, and be signed by each applicant.

All applicants must show that the individuals controlling the overseas person are of good character and collectively have the business experience and acumen relevant to the investment. An investment plan is required for investments in sensitive land, including a business plan and other details required by the OIO.

-

Cost: As of October 2016, the OIO application fees are:

- NZ$32,000 for significant business assets applications; and

- NZ$43,500 for sensitive land applications.

Consideration of the application

-

Who decides? Applications are decided by either the OIO or the responsible government minister. The Act gives these decision makers a broad discretion to refuse or grant consent, and to impose conditions.

-

Timing: The OIO is not required to make a decision within a specific time period. It has published guidelines for how long a decision may take, depending on the type and complexity of the investment. Guidelines currently range from 50 to 70 working days depending on the type of application. It is common for applications (particularly complex applications) to take longer than these targets – particularly if the OIO needs to request further information from the applicant or third parties (such as the Historic Places Trust), or ministerial approval is required.

-

Decision and monitoring: Consent may be refused, granted without conditions, or granted subject to conditions. If conditions are imposed on the consent, consent holders will generally be required to report annually to the OIO for the first five years from the date of consent as part of the OIO’s monitoring programme.

How we can help

Our experienced team can guide you through the consent process, including by:

- advising whether consent is required;

- assisting with your application, and to minimise any delays; and

- dealing with the OIO and assisting with requests for further information.

|

Contact

Darryl King,

PARTNER

Israel Vaealiki,

PARTNER

Richard Wilson,

PARTNER

|

1

1